When using, citing, or distributing the materials from this report, it is mandatory to reference the ERAI portal and include the webpage address https://index1520.com as the source of information.

China-Europe logistics market

Demand outlook

- China is accelerating fiscal stimulus for 2026, allocating 295 billion yuan ($51 billion) in advance for infrastructure, logistics («logistics cost reduction»), and strategic projects, as well as expanding consumer subsidy programs [Bloomberg]. The measure aims to support domestic demand and investment activity amid weakness in the real estate sector and external risks.

- In December, export conditions for German industry improved at the slowest pace in five months. The HCOB Germany PMI Export Conditions Index fell to 50.9, while new export orders accelerated their decline to 45.3 — the sharpest drop in a year [S&P Global]. Weak demand is observed from European and North American countries. The Asian market is more resilient, but demand from China remains subdued. This signals a weakening of Europe’s export momentum overall and limited potential for trade recovery with China in the short term, except for certain niches (AI infrastructure, data centers).

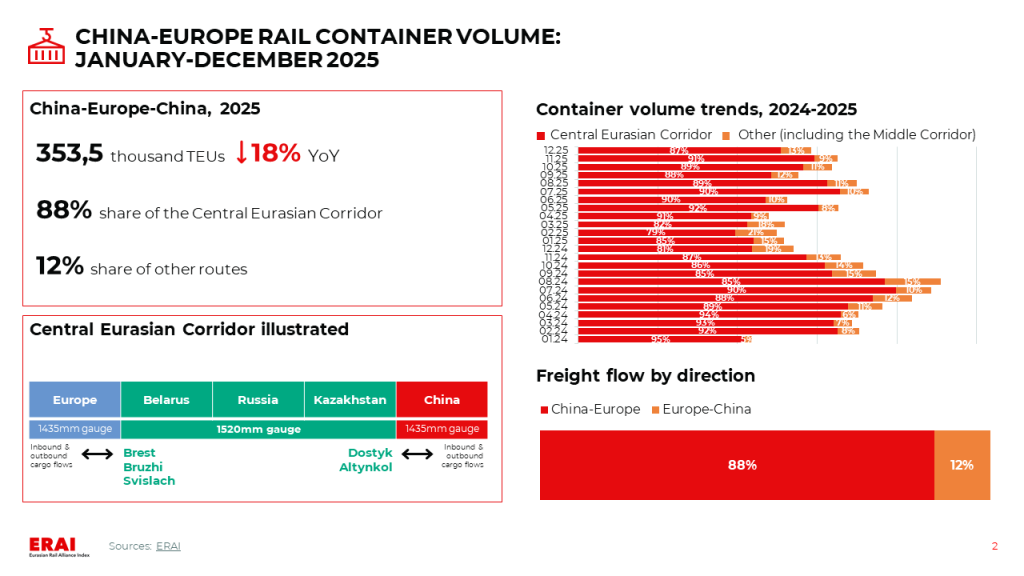

- In January-December, the volume of China-Europe-China rail container transportation decreased by 18% YoY, while the volume on the Middle Corridor increased by 14% over the year. In December, the total shipment volume across all routes grew by 8% YoY but declined by 10% MoM. Seasonal delays in the Caspian Sea limit the corridor’s potential for cargo flow growth.

- Demand for Asia-Europe sea freight remains at a high level. One of the drivers is increased shipments ahead of the Chinese New Year (17.02.2026-03.06.2026). According to Flexport, shippers are forced to move bookings to earlier dates, ensuring high utilization of all major services.

Freight rate trends

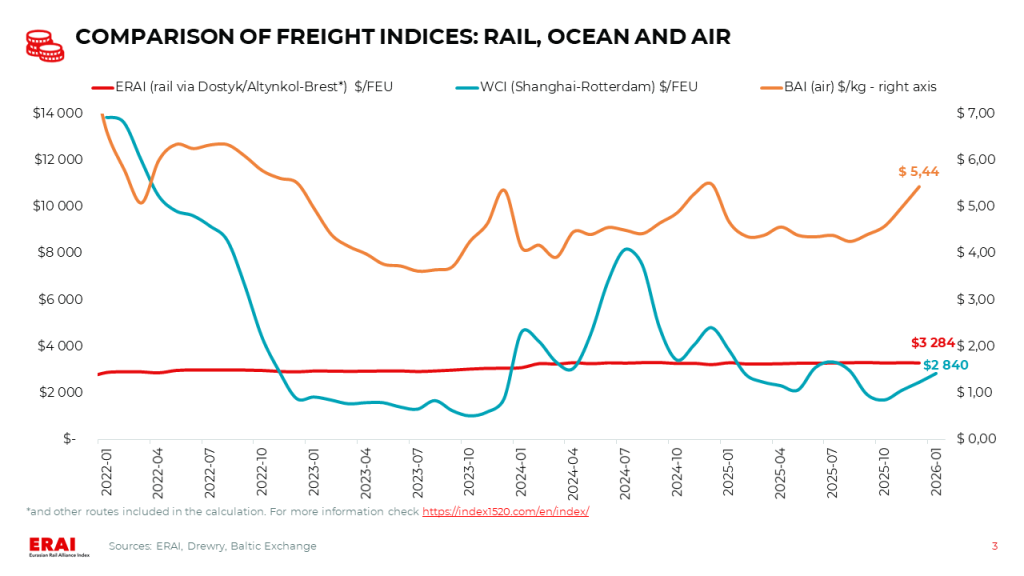

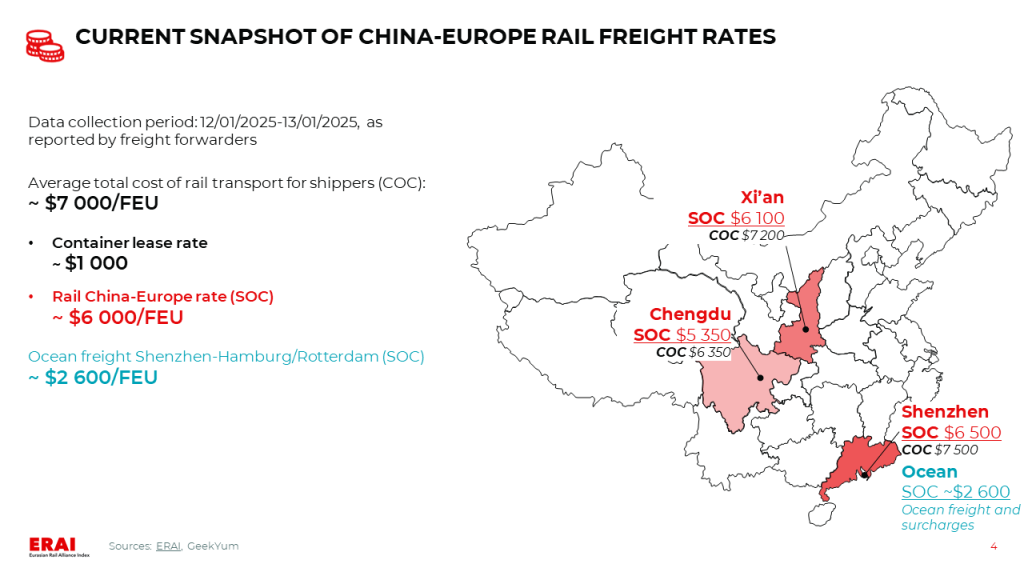

- Average cost of China-Europe rail freight via the Central Eurasian Corridor in January: ~$6 000/FEU (SOC). Rates vary by origin from ~$5 350/FEU (Chengdu) to ~$6 500/FEU (Shenzhen). Container leasing costs are approximately $1 000.

- The Shanghai-Rotterdam WCI, as of 08.01.2025, has increased to $2 840/FEU (27% Mom, −35% YoY) [Drewry]. The Shanghai-Genoa WCI has jumped to $3 885/FEU. Spot rates are most likely to continue rising amid a supply-demand imbalance. Carriers have announced an additional round of rate increases for the second half of the month. According to GeekYum, the average spot rate from major carriers for the second half of January is $2 700-3 200/FEU. Similar quote levels are observed for February.

- Participants in Asia-Northern Europe futures trading expect a decline after the first quarter, with rates in the $1 500-2 000/FEU corridor for most of 2026. Xeneta forecasts a drop in rates to 4Q2023 levels (<$1 500/FEU) even in the case of a partial restoration of Red Sea transit.

Other trends

- The State Taxation Administration of the People’s Republic of China has announced a tightening of the export VAT rebate policy. Effective April 1, 2026, the VAT rebate for the export of photovoltaic and other products (249 HS codes, including commodity items 2841, 3824, 8541) will be abolished. For storage batteries and their parts, the rebate rate will be reduced from 9% to 6% until the end of 2026, with full abolition effective January 1, 2027.

Ocean freight: short-term market uptick amid persistent medium- and long-term risks

Current Situation and Near-Term Outlook: Positive momentum continues.

- Demand for Asia-Europe sea freight remains at a high level. One of the drivers is increased shipments ahead of the Chinese New Year (17.02.2026-03.06.2026). According to Flexport, shippers are forced to move bookings to earlier dates, ensuring high utilization of all major services.

- Significant disruptions persist in Asian and European ports. The main reasons are a surge in cargo flow, as well as adverse weather conditions and issues with container handling and evacuation from European terminals (including via railway services). Snow, ice, and strong winds are particularly hindering operations in the ports of Hamburg, Antwerp, and Rotterdam [JOC]. As of 10.01.2026, port delays amounted to: 415 thousand TEU in Northern Europe (4% MoM) and 1.1 million TEU in North Asia (-1% MoM) [Linerlytica].

- The Shanghai-Rotterdam WCI, as of 08.01.2025, has increased to $2 840/FEU (27% MoM, −35% YoY) [Drewry]. The Shanghai-Genoa WCI has jumped to $3 885/FEU. Spot rates are most likely to continue rising amid a supply-demand imbalance. Carriers have announced an additional round of rate increases for the second half of the month. According to GeekYum, the average spot rate from major carriers for the second half of January is $2 700-3 200/FEU. Similar quote levels are observed for February.

- Effective January 1, with the EU Emissions Trading System (ETS) transitioning to a new phase, carriers are introducing additional surcharges. For example, has set a surcharge of $73/TEU.