When using, citing, or distributing the materials from this report, it is mandatory to reference the ERAI portal and include the webpage address https://index1520.com as the source of information.

China-Europe Logistics Market

Demand outlook

- China’s exports to the EU rose 9.2% YoY in July, as trade reorientation and resilient demand for Chinese goods continued to support cargo flows to the bloc. Imports from the EU, by contrast, fell 1.6%, reflecting subdued domestic demand in China. Both manufacturing PMIs (Caixin and NBS) unexpectedly dropped below the neutral 50 mark, with a significant drag from declining orders, including export ones [NBS, Trading Economics]. In the absence of new stimulus measures, manufacturing and shipment growth may slow, marking the imminent end of the peak season.

- July PMI data point to a modest improvement in the eurozone: manufacturing PMI rose to 49.8 — a 3-year high — yet export orders fell after a brief stabilization, posting the sharpest drop in four months [S&P Global]. Despite output growth and recoveries in select countries, external demand remains weak. By sector, new business growth was recorded in banking, transport, and tech equipment, while chemicals and pharmaceuticals saw steep declines [S&P Global]. Given the weakness in international demand, the EU’s export momentum remains constrained.

- For January—July, China—Europe—China rail container volumes fell 22% YoY. In July alone, total volumes across all competing routes declined 17% YoY but rose 40% MoM, driven primarily by gains in the central Eurasian corridor.

- As the traditional peak season winds down, demand for ocean freight from Asia to Europe is softening [Flexport]. Nevertheless, market balance remains intact in the near term. Some cargo remains unshipped, keeping vessel load factors high.

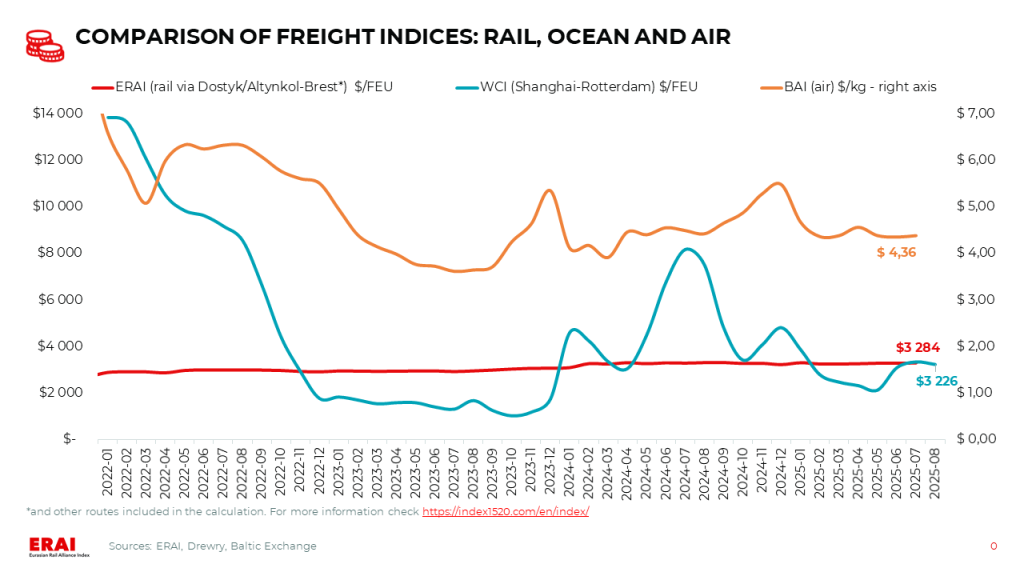

Freight rate trends

- The WCI Shanghai—Rotterdam rate was broadly unchanged last week at $3 276/FEU (-3% MoM, −59% YoY) [Drewry]. After peaking in early July, rates have been edging lower. For August, Linerlytica reports carrier guidance in the ~$2 500–2 900/FEU range. GeekYum data indicate ~$2 700–3 100, with widening pricing divergence: COSCO is holding above $4 000, while Maersk has offered $2 270 for late August. Hapag-Lloyd (Maersk’s Gemini Cooperation partner) has already announced its September rate — around $2 800/FEU. Port delays in Asia and Europe are, for now, preventing a sharper market decline.

UPDATE: As of the evening of August 14, 2025, the latest WCI Shanghai-Rotterdam reading has declined by 3% WoW — down to $3 176/FEU.

- Futures pricing, based on contracts published by the Shanghai Futures Exchange, points to a rate drop in H2, with a marked trough in September—October. The forward curve implies a decline on the Asia—Europe lane from current levels to around $2 700/FEU by end-August, and to ~$1 800/FEU by end-October.

Other trends

- China Railway Container Transport (CRCT) has joined Middle Corridor Multimodal Ltd. [Interfax], a joint venture established in 2023 by the railways of Azerbaijan, Georgia, and Kazakhstan. The decision was taken at an extraordinary general meeting in early August, following discussions ongoing since at least mid-2024 [Interfax].

- A new terminal will be built in Małaszewicze, developed by Container Terminal Mala (CLIP Group) in partnership with TorKol [Railway Supply]. The facility will handle transshipment between 1 520 mm and 1 435 mm gauges, as well as between rail and road transport. The project includes new track infrastructure, upgrades to existing lines, modern transshipment equipment, and IT systems. Completion is scheduled for June 2026.

|

|

|

Ocean Freight: a Fragile Market Equilibrium

Current Situation and Near-Term Outlook: rates are likely to remain under downward pressure, particularly given the fading seasonal momentum and the absence of new supportive factors.

- As the traditional peak season winds down, demand for ocean freight from Asia to Europe is softening [Flexport]. Nevertheless, market balance remains intact in the near term. Some cargo remains unshipped, keeping vessel load factors high.

- The WCI Shanghai—Rotterdam rate was broadly unchanged last week at $3 276/FEU (-3% MoM, −59% YoY) [Drewry]. After peaking in early July, rates have been edging lower. For August, Linerlytica reports carrier guidance in the ~$2 500–2 900/FEU range. GeekYum data indicate ~$2 700–3 100, with widening pricing divergence: COSCO is holding above $4 000, while Maersk has offered $2 270 for late August. Hapag-Lloyd (Maersk’s Gemini Cooperation partner) has already announced its September rate — around $2 800/FEU. Port delays in Asia and Europe are, for now, preventing a sharper decline.

- Significant delays persist at major hubs in Asia and Europe. As of 10 Aug 2025, disruptions affect 1.4 million TEU in North Asia (including China, +10% MoM) and 285 000 TEU in Northern Europe (-15% MoM) [Linerlytica]. In Asia, conditions are further complicated by the typhoon season, which will last through October and continue to disrupt port operations [Kuehne+Nagel]. In Europe, additional constraints stem from maintenance works and limited rail infrastructure capacity, particularly in areas adjacent to ports.