When using, citing, or distributing the materials from this report, it is mandatory to reference the ERAI portal and include the webpage address https://index1520.com as the source of information.

China-Europe logistics market

Demand outlook

- China has announced the introduction of temporary tariffs of up to 42.7% on dairy product imports from the EU [Reuters]. The measure is «anti-subsidy» in nature and aims to protect local producers. Anti-dumping duties on pork and offal imports from the EU in the range of 4.9-19.8% are also being introduced for a five-year period [China SCIO]. The measures can be viewed as a response to EU tariffs on Chinese electric vehicles. Tightening trade barriers increases the risks of trade flow redistribution between China and Europe in favor of alternative markets.

- According to preliminary results, the HCOB Manufacturing PMI index fell to 49.2 in December [S&P Global]. The slowdown in economic activity in the Eurozone is occurring against a backdrop of stagnation in the industrial sector and an accelerated decline in export orders—the December decline was the sharpest in the last 9 months. This creates an unfavorable backdrop for increasing cargo flows between Europe and China in the short term.

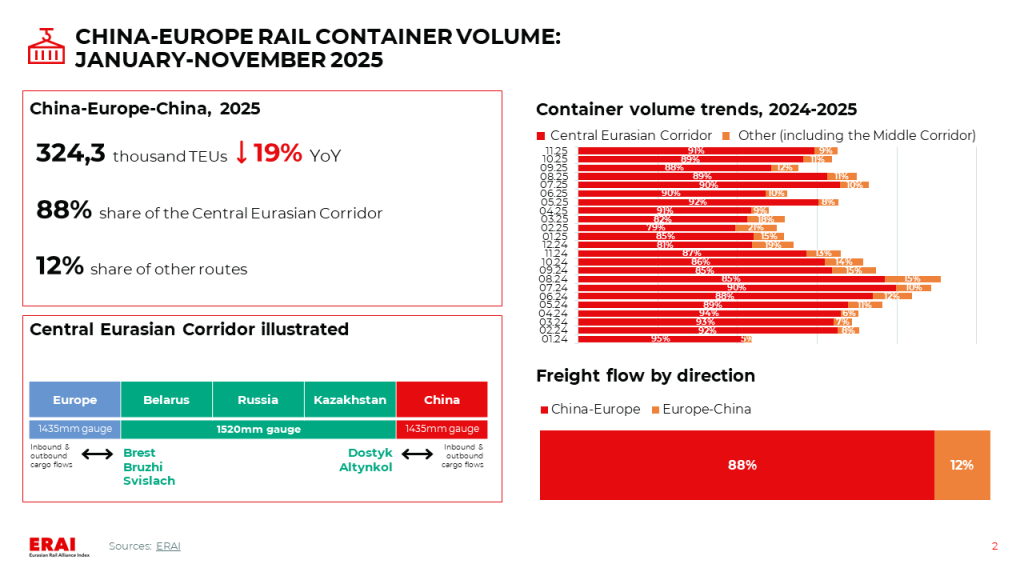

- In January-November, the volume of China-Europe-China rail container transportation decreased by 19% YoY. In November, the total shipment volume across all routes fell by 1,3% YoY but increased by 2% MoM. The volume growth in November compared to October is linked to an increase on the Central Eurasian Corridor. Conversely, a decline in container flows was noted on the Middle Corridor, partly due to seasonal delays in the Caspian Sea.

- Demand for Asia-Europe sea freight remains at a high level. One of the drivers is increased shipments ahead of the Chinese New Year.

Freight rate trends

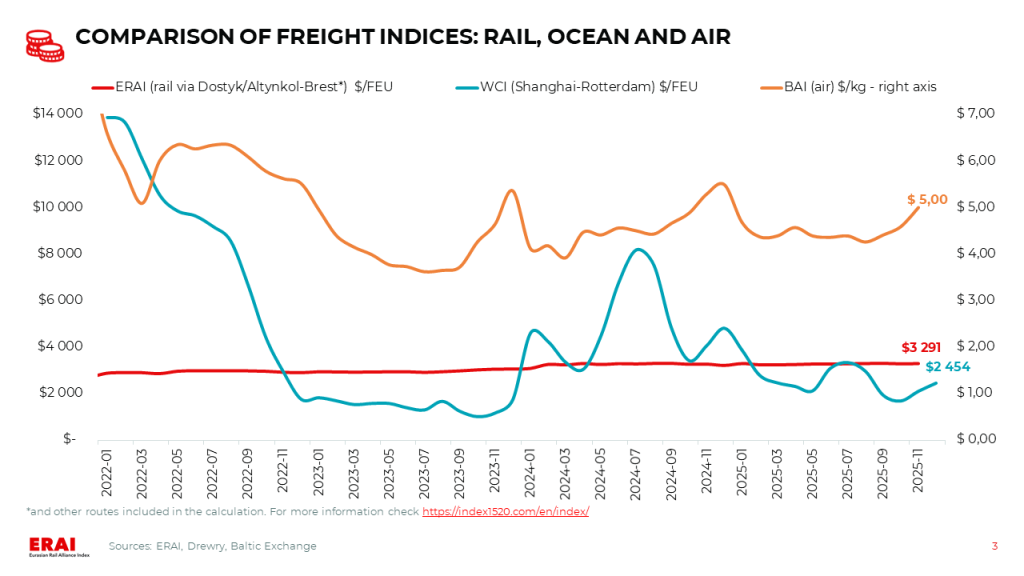

- The Shanghai-Rotterdam WCI increased by 2% last week to $2 584/FEU (19% MoM) [Drewry]. The Shanghai-Genoa WCI rose 3% for the week to $3 427/FEU. Against the backdrop of early bookings ahead of the Chinese New Year, Drewry expects further rate increases in the near term. GeekYum data shows the average spot rate from major carriers for the first half of January is $2 800-3 200/FEU.

- Futures point to a stabilization of ocean freight rates in the near term. Traders also expect rates to remain in the $1 500-2 000/FEU corridor for most of 2026.

Other trends

- A pilot project for the use of a Negotiable Cargo Document (NCD) in multimodal transportation on the China—Europe railway route has been implemented in Changsha, China [Xiaoxiang Morning Post]. Previously, the UN adopted a convention extending the application of NCDs from sea transport to also include land and multimodal transport.

Ocean freight: short-term market uptick amid persistent medium- and long-term risks

Current Situation and Near-Term Outlook: The recovery trend continues.

- Demand for Asia-Europe sea freight remains at a high level. One of the drivers is increased shipments ahead of the Chinese New Year.

- Operations in Northern European and Asian ports are normalizing, but delays persist at major hubs. As of 30.12.2025, port delays amounted to: approximately 284 thousand TEU in Northern Europe (-20% MoM) and approximately 1.1 million TEU in North Asia (-17% MoM) [Linerlytica].

- The Shanghai-Rotterdam WCI increased by 2% last week to $2 584/FEU (19% MoM) [Drewry]. The Shanghai-Genoa WCI rose 3% for the week to $3 427/FEU. Against the backdrop of early bookings ahead of the Chinese New Year, Drewry expects further rate increases in the near term. GeekYum data shows the average spot rate from major carriers for the first half of January is $2 800-3 200/FEU.

- According to Xeneta, the long-term contract rate on the Asia-Northern Europe route in December 2025 is approximately $2 200/FEU. Actual transit time reached 52 days, with schedule reliability at just 27.5%.

- Medium- and Long-Term Outlook: The overall trend continues to point towards a growing supply-demand imbalance and intensifying competition.

- The expected decline in rates in 2026-2027 may be accompanied by a further deterioration in service quality [JOC]. Sea delivery is becoming less reliable in terms of meeting deadlines. Key factors include chronic port congestion (especially in Northern Europe), increasing vessel sizes against limited terminal capacities, and increasingly aggressive capacity management by carriers (blank sailings, slow steaming, etc.).

- For cargo owners and importers, this translates to a more favorable pricing environment, but lower service quality, poorly predictable delivery times, and the need to increase safety stock levels.