China-Europe logistics market

Demand outlook

-

The eurozone’s manufacturing sector shows signs of stabilization in February, with improved delivery times, a slowdown in production cuts and purchasing activity [S&P Global]. However, weak demand continues to have a negative impact. The situation remains critical in the machinery and automotive sectors, reinforcing the general pessimism in the export sector on the horizon of the next 12 months [S&P Global].

-

Trade between China and Europe is facing two key challenges: the growth of mutual barriers and the tightening of the US tariff policy. The most likely scenario is a partial normalization of relations between China and Europe while maintaining pressure on the Chinese car industry and other sectors. The EU has to balance between protecting its market and trying to avoid a full-scale trade war with the US and China.

-

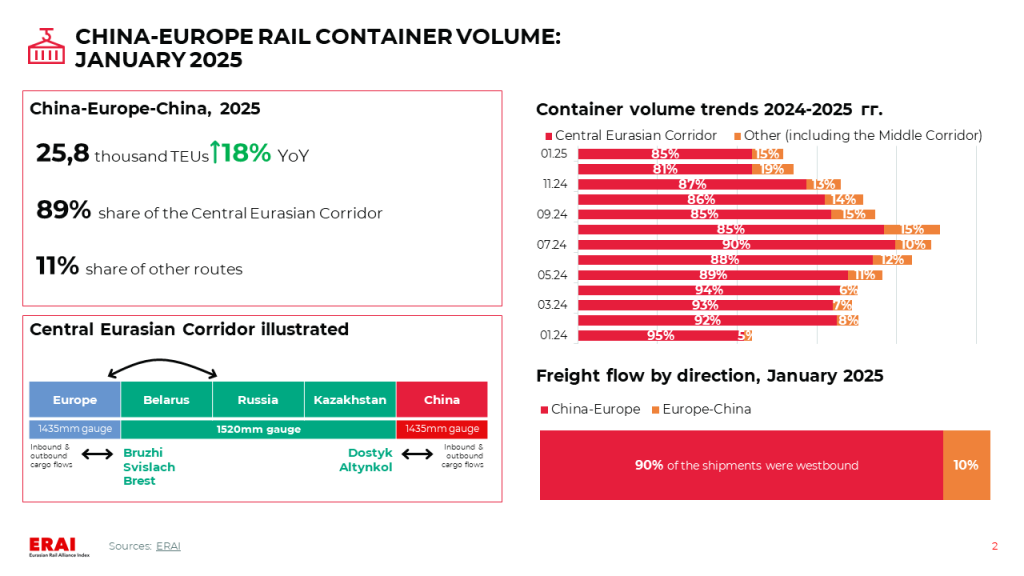

In January, the volume of rail container freight between China and Europe decreased by 4% MoM, primarily due to a reduction in shipments via the Middle Corridor (-23% MoM) and a significant decline in volumes from Europe to China (-48% MoM).

-

There are no significant changes in demand in the sea transportation market. In the near term, the market is likely to remain under pressure due to overcapacity. With no systemic cancelations of shipments, the balance between supply and demand may worsen. At the same time, there are no problems with container availability in China. According to Container xChange, container rental rates continued to decline in February.

Freight rate trends

-

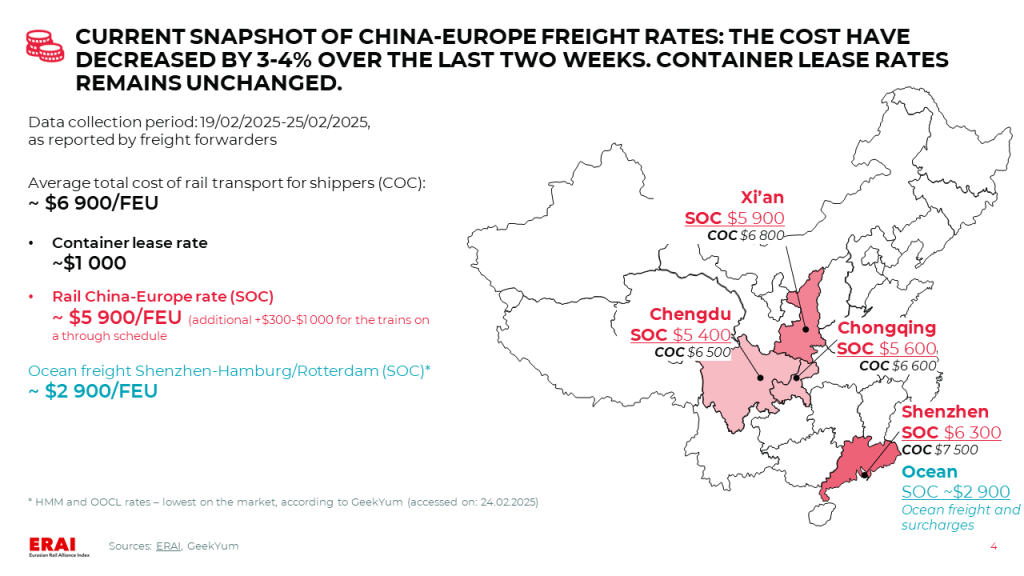

Rail freight rates for the major China-Europe routes (SOC) have decreased by 3-4% over the last two weeks. The average rate ranges from $5 550 (Chengdu) to $7 200/FEU (Shenzhen). Container lease rates remains unchanged.

-

WCI Shanghai-Rotterdam dropped by 24% MoM, to $3,125/FEU (-38% YoY) [Drewry]. Lines take the initiative and shift towards the strategy of raising rates. In the short term, freight rates may repeat the usual cycle: growth amid GRI and subsequent downward pullback. In the long term, rates are likely to continue to decline.

Other trends

-

Turkey modernizes railway infrastructure in a bid to strengthen its role in the China-Europe route via Middle Corridor [The Loadstar]. China is considering investing $60 billion to expand and electrify Turkey’s rail network.

-

Kazakhstan is also actively developing infrastructure and strengthening its status as a key transit center: Chinese Railways will join «MIDDLE CORRIDOR MULTIMODAL Ltd.» (Joint Venture of Kazakhstan, Azerbaijan and Georgian Railways) in March 2025. [Қазақстан темiржолшысы]; construction of a container hub in the port of Aktau (a joint project of KTZ and Lianyungang Port GC LLC) will be completed in 2025 [Қазақстан темiржолшысы]; Shaanxi province invests 2.5 billion yuan (~$340 million) to develop China-Europe container trains [Қазақстан темiржолшысы].

China-EAEU logistics market

Import and export trends

-

The Bank of Russia decided to keep the key rate at 21% on February 14, 2025. Current inflationary pressures remain high. The growth of domestic demand continues to significantly outpace the expansion of the supply of goods and services. At the same time, the cooling of credit activity has become more evident, and the households’ tendency to save is growing [Bank of Russia]. Annual inflation is still well above 4%. A tight MPC will help to slow down the inflation rate and bring it back to the target in 2026 [Bank of Russia]. High price growth and reduced consumer demand will have a negative impact on imports into Russia in the short term.

-

EU approves 16th package of anti-Russian sanctions. Among the areas affected: cutting off 13 banks from SWIFT, restrictions on 74 vessels of the «shadow fleet», ban on supplies of software, equipment and technologies for oil and gas production, as well as sanctions against the ports of Astrakhan, Makhachkala, Ust-Luga, Primorsk, and Novorossiysk [Kommersant, Gruzopotok].

-

Sales of used passenger cars increased by 30% YoY in January due to a low 2024 base, favorable offers and expected price revisions. Demand is expected to shift further towards the aftermarket due to slower price growth compared to new cars [Kommersant].

-

«Belaruskali» announced a possible reduction of potash fertilizer output in 2025 by 1 million tons due to repair works. The market expects potash prices to rise, including due to the expected introduction of US duties on Canadian exports [Kommersant]. According to Forbes, The US is ready to make a deal and ease sanctions against Belarusian potassium chloride, fertilizers may start to be supplied to the US market instead of Canadian ones.

-

Import rates from China to Moscow continued to decline via direct rail and multimodal transport. Direct train rates are at~$7 300/FEU, which is ~$500 lower than two weeks ago. Rates for freight through the ports of the Far East decreased by~$150 up to ~$5 650/FEU, while the railroad component increased to ~$4,400, largely due to the exchange rate difference.