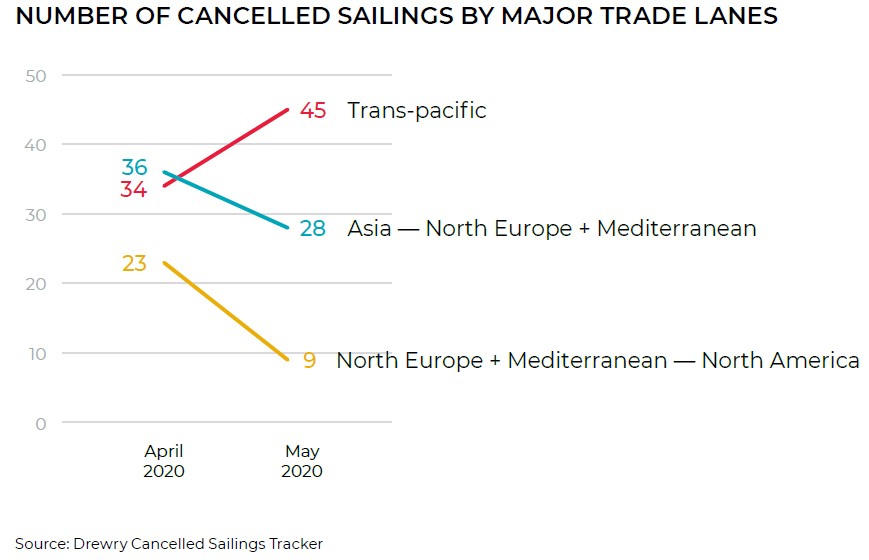

Cargo transportation industry is facing difficulties caused by the COVID-19 pandemic. Over 90% of the total worth of trade between Europe and China is performed by the sea and air transport, however presently the cargo transportation volumes in these sectors are declining. In the sea transportation market, it resulted in cutting 20% trans-Pacific capacity to prevent further decline of carriage rates. In May, a total of 25 to 30% sailings in Asia and Europe will be cancelled.

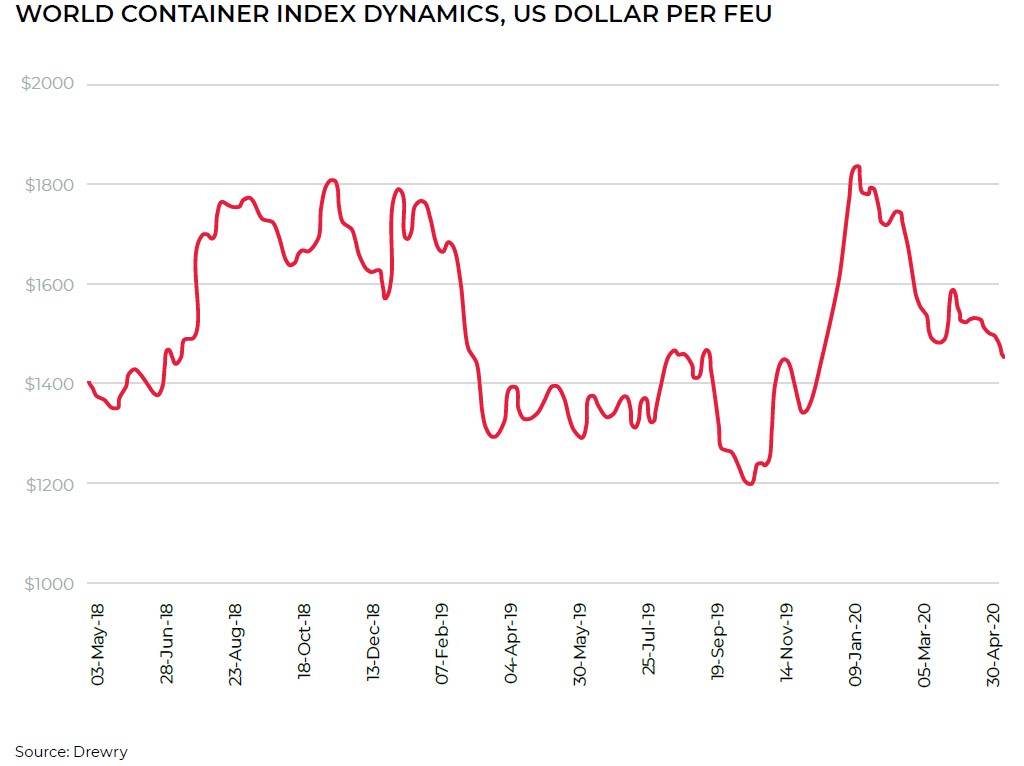

Apart from blank sailing, carriers optimize their operation costs through changing delivery routes, by offering consignors to opt for other delivery terminals or intentionally extending lead times; termination of scrubber installation contracts; using delayed payment for terminal services. The sea transportation industry has an inherent feature of time lag in response to external factors, as the lead times are longer compared with the other modes of transport. Thus, Europe is presently receiving cargoes ordered by European consignees before enactment of the quarantine restrictions. It is possible that the industry will feel the entire impact of the crisis shortly.

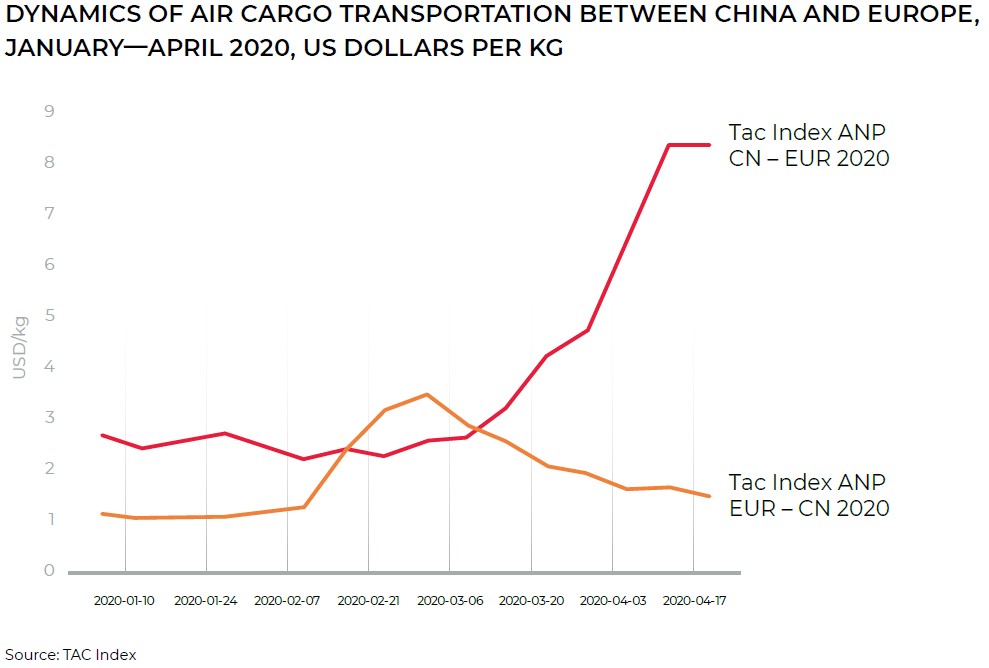

Contrary to sea cargo transportation, the aviation industry has mostly suffered from governmental traveling bans. More than a half of the global volume of air cargoes travel in the passenger aircraft, and closing of borders led to the loss of half of the cargo transportation capacity. This caused a disbalance between demand and supply in the market, and the air transportation rates, specifically from China to Europe, have spiked. Carriers started adapting to the existing market conditions: airlines have redistributed their asset in favor of more economic types of aircraft and started carrying cargoes in passenger cabins. Owing to this solution airlines were able to meet some of the demand in urgent transportation of personal protective equipment and medications, which helped only slightly reduce the cargo transportation rates in May. Nevertheless, carriers are still facing such problems as the lack of funds, irrational choice of delivery routes due to the overloaded and inaccessible airports, increased aircraft loading time etc.

Many transport operators are presently opting in favor of multimodal shipments using railroad transport, firstly, as a more reliable mode of cargo transportation between the major consumption centers (Europe and China) in the conditions of the pandemic and, secondly, in view of the large-scale plans to develop this type of transport in the scope of greenhouse gas emission reduction. Possibly the consignors need to take this into account in further planning of their cargo forwarding. Besides, diversification of modes of transport is a key tool for mitigation of risks emerging in the present volatile state of the global economy.

Overall, according to the global cargo transportation market development forecasts, the crisis will impact the market players worldwide, even in the countries where the incidence of the disease was relatively low. Companies should focus their crisis recovery policies on balancing supply and demand and preparing to all scenarios of demand dynamics. Besides, an important decisive factor of further development of the transportation industry is governmental policy in its financial support, since large-scale bankruptcy of minor companies can drive yet another wave of recession and slow down the global economic recovery.