The Northern Sea Route (NSR) is the shortest sea route between Europe and East Asia, as well as between the European and Far Eastern parts of Russia. The Northern Sea Route is part of the Northern Transport Corridor, which runs from the port of Murmansk to Cape Dezhnev. The NSR passes through the seas of the Arctic Ocean (Barents, Kara, Laptev, East Siberian, Chukchi and Bering).

Year-Round Navigation

One of the most significant stages in the development of the NSR was the opening of year-round navigation, which involved solving many technical and infrastructural problems, since the implementation of year-round navigation along the Northern Sea Route will only be possible after the creation of a fleet of vessels equipped with an Arctic ice class of at least Arc7.

In addition, year-round navigation opens up opportunities for increasing transit traffic, as evidenced by the growth in the volume of transit cargo, which reached a historical record in 2023 (2.129 million tons) and 2024 (more than 3 million tons).

In the coming years, the development of year-round transportation along the NSR will depend on progress in the creation of icebreakers and the coordination of Russia’s efforts to ensure the safety of navigation on this route.

Freight transportation statistics

In 2024, the volume of cargo transportation along the NSR reached a record high of 37.9 million tons, which is 4.4% more than in the previous year.

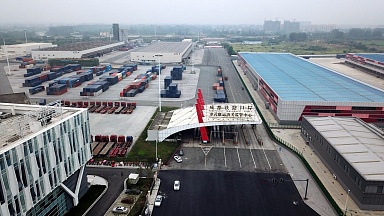

According to InfraNews, container turnover along the NSR in 2024 showed significant growth, reaching 193.8 thousand TEU, which is 17.7% (29.08 TEU) higher than in 2023 (164.7 thousand TEU).

The main volume of container handling was cabotage, which increased by 8.3% (almost 14 thousand TEU) over the year, reaching 176 thousand TEU. At the same time, export handling increased 13-fold, amounting to 10.5 thousand TEU, and import handling increased sixfold, reaching 6.9 thousand TEU.

The main contribution to this growth was made by the largest ports of the country, in particular the port of Arkhangelsk, which showed an increase of 14.5 thousand TEU (+44.8%) with a total share in container turnover along the NSR of 24.2%, and the port of Murmansk with an increase of 8.9 thousand TEU (17.9%) with a share in container turnover along the NSR of 30.4% — the growth was mainly due to export and cabotage transportation. The leader in terms of container turnover (33.1%) remains the port of Dudinka, mainly serving the cargo flow of MMC Norilsk Nickel, which, however, did not show a significant increase in container turnover (in 2024, it amounted to 300 TEU). The entire container turnover of the port is made up of cabotage transportation.

Crude oil remains the most important transit cargo, accounting for 62% of all shipments. In 2024, 1.89 million tons of oil were transported in 18 trips from Primorsk, Murmansk and the Prirazlomnaya platform.

Bulk cargo took second place in terms of NSR transit shipments, reaching 877 thousand tons. Iron ore concentrate accounted for most of this, with a volume of 475 thousand tons (15%). Coal transportation included three trips from Ust-Luga and one from Murmansk, a total of 316 thousand tons (10%). In addition, two trips with a total volume of 86 thousand tons (3%) of fertilizer were made from St. Petersburg.

The majority of cargo, accounting for 95% of the total transit volume, is sent from Russia to China, reaching a volume of 2.9 million tons. Transportation between Russian ports accounts for less than 1% of the total volume of cargo traffic. This fact underscores the strategic importance of the NSR as part of the trans-Eurasian trade routes linking Russia with Asia.