Surging container prices is a complicated topic to digest. Although it results from multiple factors, it appears that container providers have the biggest share in shaping the market. Yet, there is a role to play by rail freight too, Onno de Jong pointed out. You can watch the whole presentation below.

The text continues below the video

Why do prices rise?

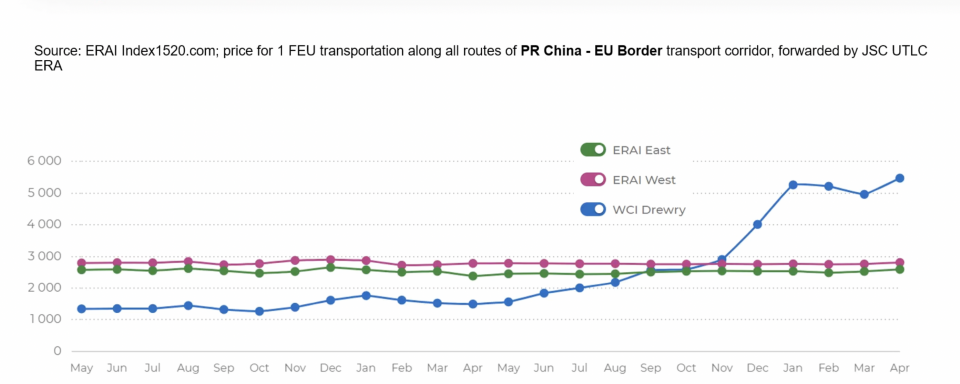

First of all, container prices derive from the market’s supply and demand shifts. However, the market has a limited number of players originating from deep-sea shipping, and “they do not always make the most rational decisions”, underlined de Jong. This practically means that these players could decide at any moment to decrease the container supply, leading to greater demand and, respectively, higher prices. That is why most of the time, price increases result from shifts in maritime transport.

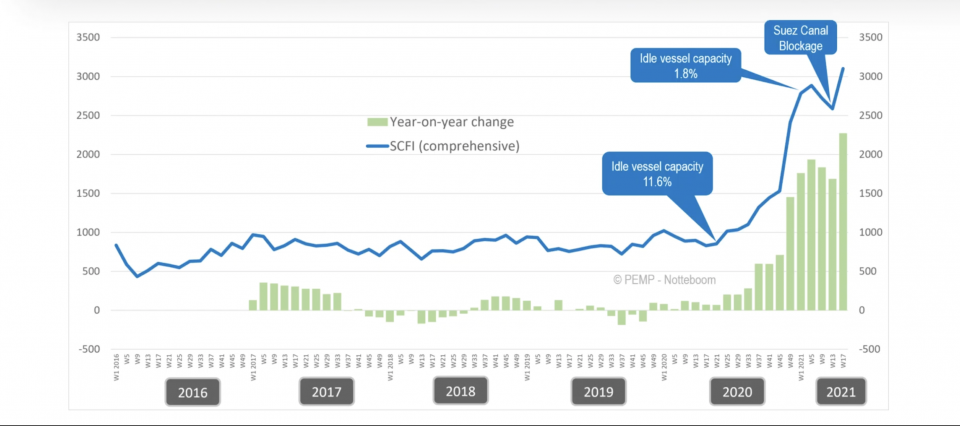

During periods of crises, container prices are also subject to significant shifts. Take, for example, the Covid-19 pandemic. Until the beginning of 2020, container prices were relatively low and stable for a long time. The pandemic’s outbreak resulted in a continuous price increase that reached unprecedented high levels. The same applied during the Suez blockade last March. So, is there a specific reference point to follow regarding container prices? The answer is ambiguous. Yes, because supply chain disturbances can lead to price differences, and no, because it’s all about decision making from the side of big players in the market.

What is the current situation?

At the moment, the container market is going through some extraordinary conditions that affect it heavily. According to de Jong, the past year and the coming months are entirely different from any other period. There are six reasons to explain the current situation:

- Supply chains are still under stress due to the scaled-down production following the pandemic’s outbreak in 2020.

- The faster than expected recovery of the market following the pandemic led to shortages in many supply chains.

- The container schedules adjusted to the scaled-down production. When production stepped up, it resulted in constraints.

- Imbalances because of empty containers worsen the situation.

- The Suez blockade was an extra aggravating disruption.

- Finally, forwarders chartering their own smaller container ships do not prove beneficial for the market.

Rail freight also plays a role in the situation. Specifically, the fact that China Railways decided to ban the export of its containers worsened the equipment scarcity.

Pressure on rail

When it comes to hinterland transport, rail freight understandably experiences the effects of the container market instability. For instance, import-export imbalances lead to port congestions that intensify the inland transportation bottlenecks. This affects the punctuality of trains. The Netherlands constitute such an example where the timeliness of freight trains has been reduced over the last few months, “most probably due to the problems caused at the ports”, highlighted de Jong.

Simultaneously, rail freight can play a role in altering the status quo. At least the China-Europe rail connections could “come to the rescue”, de Jong pointed out. 2020 has been the most successful year because Eurasian trains reached and exceeded the one million transported TEUs milestone. Rail has acquired a more prestigious position and is now a credible alternative to maritime transport in terms of reliability and prices. The new services that enter the market with an intermodal profile are equally important in that sense.

Traps to avoid

However, de Jong ringed the alarm bell for rail freight: the sector should keep up the good work but avoid doing more than it can handle. As he emphasised: “Rail should not dig its own grave and become as congested and unreliable as deep-sea shipping”.

That being said, rail freight can become the key to improving the instability of container prices and the imbalances that cause congestions. Such a process demands time and good management because otherwise, the sector could end up in a vicious cycle.