The COVID-19 pandemic has triggered a mobility crisis, mainly because of physical distancing requirements and the necessity to avoid confined spaces. Having a disastrous impact on the global transport sector with air passenger transport as the most affected segment, the pandemic also affected other modes of transport such as railways. However, the economic activity was already decelerating before the crisis, and the transport sector already had to deal with several issues and challenges. The slowdown in the global economy and the ensuing shock in the form of COVID-19 affected not only carriers, but also manufacturers and the supply chain, especially in the aerospace industry.

For the railway segment, the overall impact is also negative even though the effect on rail freight seems to vary from one region to another. On one side, rail freight is complementary to air and sea freight, but is not substitutable. In the U.S., for instance, imports from Asia and Europe are transported either by sea or by air, but cannot be carried by railway. In that respect, Union Pacific, one of the biggest U.S. railway companies, recorded a 22% YoY decrease in volume in Q2. However, in Eurasia, there is some substitutability between air and maritime freight on one side, and railway on the other. In this configuration, a decrease in air and sea freight leads to an increase in rail freight. So the rail transit traffic between China and Europe was 180% higher in May 2020 than a year earlier. This surge is due to both COVID‑19 and a longer-term project, the Belt and Road Initiative.

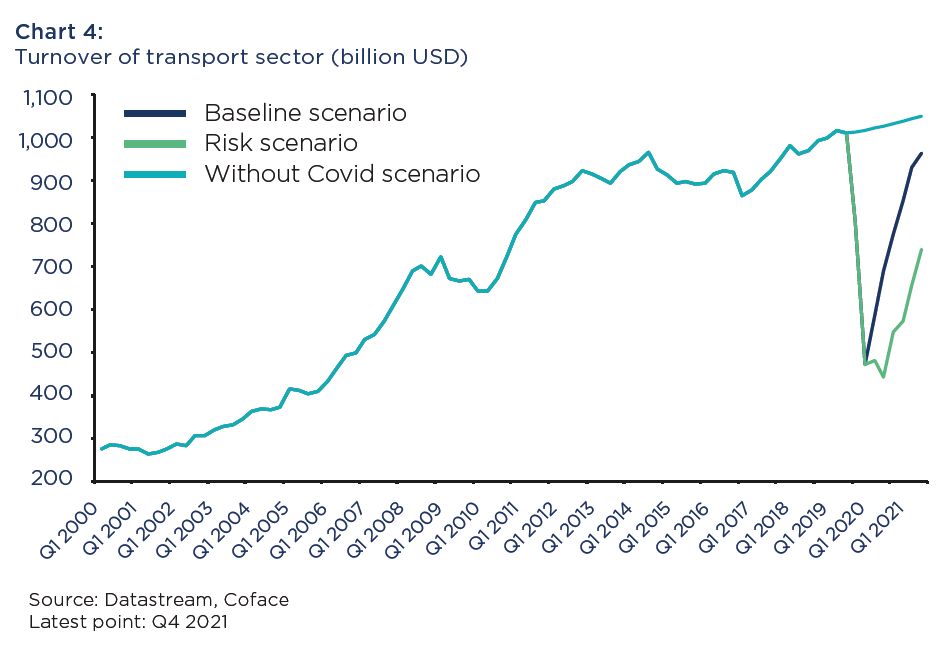

In the report, COFACE does not expect the sector to recover to fourth quarter (Q4) 2019 level before 2022. In COFACE’s central scenario, the turnover of listed companies of the global transport sector will be 32% lower in Q4 2020 than in Q4 2019. In a “risk scenario”, in which a second wave of the pandemic materializes in Q3 2020, the turnover would be 57% lower in Q4 2020. The ecological agenda also exerts a long-term impact on the transport segment (CO2 emissions from transport accounted for 20% of emissions from fuel combustion). On 1 January 2020, IMO 2020 regulation set by the International Maritime Organization came into force. Air transport is also subject to a legal framework that aims to reduce the environmental impact, primarily by the UN International Civil Aviation Organization, Regional efforts are also notable, like in France where the government decided to remove domestic flights “for which there is a rail alternative less than two and a half hours long.” In this regard, the rail freight has a competitive advantage over the other modes.