When using, citing, or distributing the materials from this report, it is mandatory to reference the ERAI portal and include the webpage address https://index1520.com as the source of information.

China-Europe logistics market

Demand outlook

-

According to estimates by RatingDog and S&P Global, China’s manufacturing growth accelerated slightly in January 2026. The PMI index rose to 50.3 (a 3-month high). One of the drivers was a notable increase in export orders, particularly from Southeast Asia. However, business confidence fell to a 9-month low amid concerns over economic prospects and rising costs.

-

In January 2026, final data shows that Eurozone industrial production returned to modest growth. The HCOB Eurozone Manufacturing PMI Output Index rose to 50.5 following a December contraction, but the overall manufacturing PMI remained in contraction territory (49.4) [S&P Global]. Export orders predictably declined again. This indicates persistent weakness in external demand, including from Asia, and provides no signals of a revival in shipments from Europe to China in the short term.

-

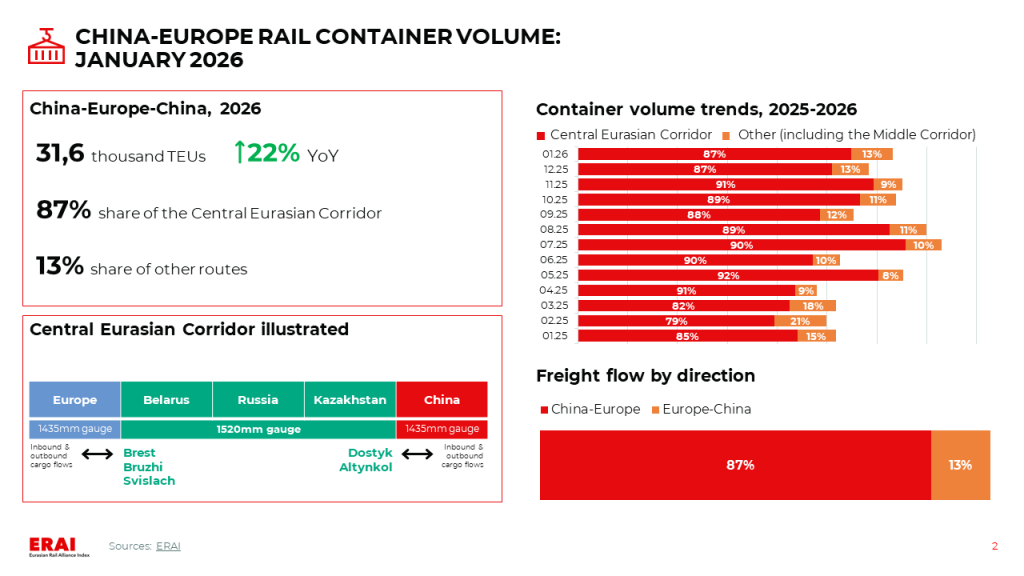

In January, China-Europe-China rail container volume increased by 22% YoY. Giving a breakdown, growth on the Central Eurasian Corridor reached 25% YoY, while the Middle Corridor also showed positive dynamic — 7% YoY. Compared to December, total container volume rose by 8% MoM.

-

Demand for Asia-Europe sea freight is declining as the Chinese New Year (17.02.2026-03.03.2026) approaches. According to Flexport, manufacturing activity in China has started to slow down and the bulk of volumes have already been shipped.

Freight rate trends

-

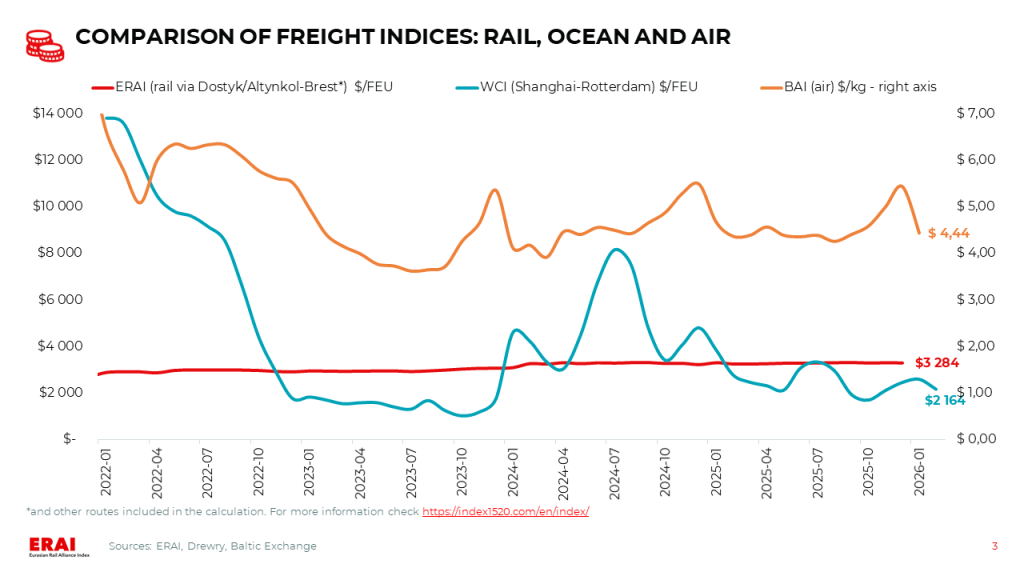

The WCI Shanghai-Rotterdam, as of 05.02.2026, fell to $2 164/FEU (-23% MoM, −31% YoY) [Drewry]. The WCI Shanghai-Genoa dropped to $3 048/FEU.

UPDATE: As of the evening of February 12, 2026, the latest WCI Shanghai-Rotterdam reading has declined by 2% WoW — down to $2 127/FEU.

In February, carriers are focused on maintaining the current rate levels. According to GeekYum, the average spot rate for February is $2 000-2 500/FEU. In early March, Flexport, expects the market to face capacity shortages due to blank sailings, which will contribute to a short-term spike in rates during the final part of Q1 2026. DHL Global Forwarding suggests the possibility of rate increases in light of China’s upcoming tightening of export VAT rebate rules. For March, CMA CGM and HMM are quoting rates >$3 000, while Maersk is offering spot freight as low as $1 900/FEU. The market remains highly sensitive to external pressures. -

Futures traders expect a slump after Q1 2026 and ocean freight rates to remain in the $1 500-2 000 corridor for the remainder of 2026.

Other trends

- Chinese e-commerce platforms have strengthened their presence in the EU market, leveraging regulatory and customs exemptions, which has drawn complaints from European businesses and is accelerating the tightening of regulations [JOC]. Stricter EU regulation, including the abolition of the duty-free threshold (for goods valued at <€150) from mid-2026, is accelerating the shift away from the small-parcel model from China and stimulating cargo consolidation. Some e-commerce companies have already begun opening logistics hubs near key consumer markets for subsequent regional distribution (e.g., the Shein project near Wroclaw) [Les Echos]. In this context, rail services could emerge as a compromise solution between sea and air freight in terms of both transit time and cost.

Ocean freight: the market is entering a phase of seasonal cooling, with a risk of further deterioration in the supply—demand balance

-

Demand for Asia-Europe sea freight is declining as the Chinese New Year (17.02.2026— 03.03.2026) approaches. According to Flexport, manufacturing activity in China has started to slow, and the bulk of volumes have already been shipped.

-

Significant delays persist in Asian and European ports. The main reasons are high terminal utilization, adverse weather conditions and container handling difficulties (particularly in European ports) [Kuehne+Nagel]. As of 08.02.2026, delays amounted to: 291 thousand TEU in Northern Europe (-15% MoM) and 1.1 million TEU in North Asia (4% MoM) [Linerlytica].

-

Schedule adjustments, disruptions in Northern European ports and equipment shortages in China are constraining supply volumes, preventing a spot rate collapse. Announced blank sailings for weeks 8–9 indicate carriers’ intention to actively manage supply.

-

The WCI Shanghai—Rotterdam, as of 05.02.2026, fell to $2 164/FEU (-23% MoM, −31% YoY) [Drewry]. The WCI Shanghai—Genoa dropped to $3 048/FEU. In February, carriers are focused on maintaining the current rate levels. According to GeekYum, the average spot rate for February is $2 000–2 500/FEU. In early March, Flexport, expects the market to face capacity shortages due to blank sailings, contributing to a short-term spike in rates during the final part of Q1 2026. DHL Global Forwarding suggests possible rate increases in light of China’s upcoming tightening of export VAT rebate rules. For March, CMA CGM and HMM are quoting rates >$3 000, while Maersk is offering spot freight as low as $1 900/FEU. The market remains highly sensitive to external pressures.

-

Maersk and Hapag-Lloyd have confirmed a partial return to Suez Canal routings [JOC]. For example, the ME11/IMX service (India — Middle East — Mediterranean) will be shifted starting mid- February. According to DHL Global Forwarding’s optimistic scenario, a return of regular services via the Red Sea is unlikely before 2H2026.