When using, citing, or distributing the materials from this report, it is mandatory to reference the ERAI portal and include the webpage address https://index1520.com as the source of information.

China-Europe logistics market

Demand outlook

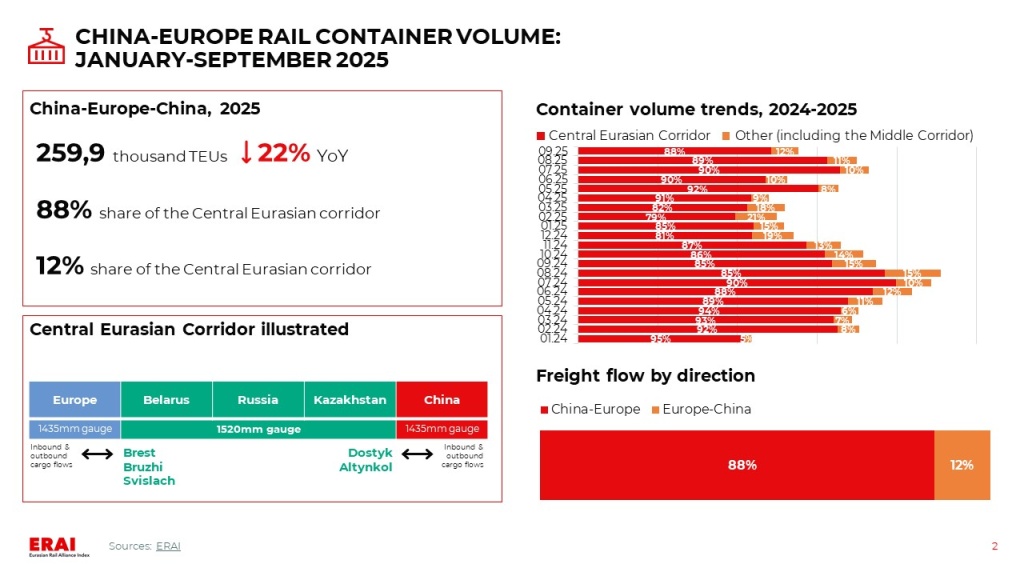

- China’s official manufacturing PMI, published by the NBS, fell in October to a six-month low of 49.0. The slowdown is linked to weak domestic demand, a holiday pause, and foreign trade risks. For comparison, the RatingDog and S&P Global index, which tracks activity among SMEs and export-oriented enterprises, rose to 50.6. The growth in new orders and production volumes continued but was less pronounced due to a reduction in export orders amid trade uncertainty. This may signal a slowdown in China’s foreign trade growth in the coming months.

- The Eurozone’s manufacturing sector showed signs of stabilization in October. The HCOB Manufacturing PMI rose to 50.0 [S&P Global]. The growth rate remains moderate against a backdrop of stagnating new orders and declining employment. Companies continue to reduce stocks of raw materials and finished products, indicating no reversal in the inventory cycle and persistent weak demand. An additional constraint remains disruptions in semiconductor supplies, affecting the automotive and engineering industries.

- Rising imports from China are raising questions about protecting the EU market [Reuters]. In response, the European Commission is ramping up monitoring of Chinese goods and preparing defensive measures. In September 2025, shipments from China to Europe increased by 14% YoY. In the first half of the year, EU imports of hybrid cars from China doubled, while for a number of niche goods, growth reached tenfold. imports of ecommerce goods have already surpassed last year’s figures. At Liège Airport (Belgium), a key logistics hub for Alibaba, a 23% YoY growth was recorded in 3Q2025.

- Demand for Asia-Europe sea freight continues to gradually recover. A surge in bookings was observed in late October ahead of a general rate increase (GRI). In November, according to current Flexport estimates, demand levels are expected to hold steady.

Freight rate trends

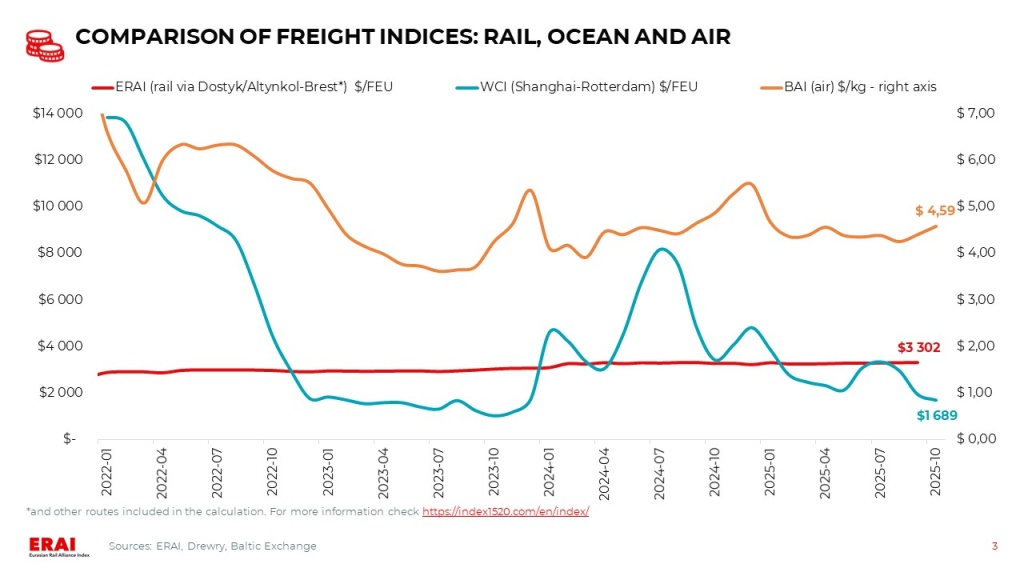

- The WCI Shanghai-Rotterdam increased by 3% over the past week — to $1 795/FEU (11% MoM, −47% YoY) [Drewry]. This positive trend is likely to continue. According to GeekYum, for the first half of November, the average spot rate from major carriers is around $2 400/FEU, while for the second half of the month, offers are starting from $2 500/FEU (only some carriers have published their rates so far). On the other hand, data from Linerlytica suggests that market stabilization could limit the potential for further rate increases.

- Futures pricing points to a moderate increase in ocean freight rates through the end of 2025. Specifically, Asia—Europe rates are projected to gradually rise to approximately $2 500/FEU by the end of this year.

UPDATE: As of the evening of November 6, 2025, the latest WCI Shanghai-Rotterdam reading has risen by 9% WoW — up to $1 962/FEU.

Other trends

- According to reports from Chinese forwarders, from October 28 to 31, emergency track maintenance is being conducted at the Terespol station (Poland), involving a partial closure of the 1520 mm gauge tracks. Train movement across the border may be temporarily restricted. Scheduled repair works are planned from November 3 to 7, during which time rail traffic via the Terespol-Brest crossing will be suspended.

- The Chinese carrier Sea Legend Shipping has announced plans to perform 16 voyages via the Northern Sea Route (China-Europe Arctic Express) in 2026 [gCaptain]. The sailings will be carried out during the summer-autumn navigation period from July to November.

- Poland will receive €451.5 million from the EU under the Connecting Europe Facility (CEF) 2024 program to modernise a section of Rail Baltica and improve access to ports, among other initiatives [China.org.cn].

|

|

Ocean freight: the market is experiencing a short-term upswing, though medium- and long-term risks persist

Current Situation and Near-Term Outlook: the recovery trend continues.

- Demand for Asia-Europe sea freight continues to gradually recover. A surge in bookings was observed in late October ahead of a General Rate Increase (GRI). In November, according to current Flexport estimates, demand levels are expected to hold steady.

- Significant operational disruptions persist in Northern European ports. The cause is sustained import volumes amid ongoing constraints on container handling and evacuation. In recent weeks, according to Kuehne+Nagel, the situation has been exacerbated by adverse weather conditions. As of November 2, 2025, port delays amounted to: 447 thousand TEUs in Northern Europe (98% MoM) and 1.525 million TEUs in Northern Asia (-1% MoM) [Linerlytica].

- The WCI Shanghai-Rotterdam increased by 3% over the past week — to $1 795/FEU (11% MoM, -47% YoY) [Drewry]. This positive trend is likely to continue. According to GeekYum, for the first half of November, the average spot rate from major carriers is around $2 400/FEU, while for the second half of the month, offers are starting from $2 500/FEU (only some carriers have published their rates so far). On the other hand, data from Linerlytica suggests that market stabilization could limit the potential for further rate increases.

- CMA CGM has, for the first time in two years, initiated test transits of Ocean Alliance vessels through the Red Sea [JOC]. Two container ships have been routed to Asia via the Suez Canal. However, the company does not plan to resume transit on a large scale in the near term unless the security level in the region improves significantly.

UPDATE: As of the evening of November 6, 2025, the latest WCI Shanghai-Rotterdam reading has risen by 9% WoW — up to $1 962/FEU.