When using, citing, or distributing the materials from this report, it is mandatory to reference the ERAI portal and include the webpage address https://index1520.com as the source of information.

China-Europe logistics market

Demand outlook

-

In September, China’s manufacturing PMI rose from 50.5 to 51.2, reaching its highest level in six months [S&P Global]. The main driver was accelerated growth in new orders, including export orders, which returned to positive growth for the first time since March. This growth may be linked to increased activity on intra-regional and other export routes (South America, Africa), where sustained demand for transportation was previously observed. The order increase led to active inventory replenishment and higher production volumes. Chinese companies ramped up raw material purchases at the fastest pace since November 2024.

-

The Eurozone manufacturing PMI fell to 49.8 in September from 50.7 in August, indicating a deterioration in business activity amid declining new order volumes and reduced employment [S&P Global]. New export demand has contracted for the third consecutive month, particularly for companies in Germany, France, and Italy. To optimize inventories, companies significantly reduced procurement volumes. Business expectations remained positive but hit their lowest level since April.

-

The European Commission has approved the introduction of a 50% tariff on steel imports—double the current level applied after quota exhaustion. The volume of duty-free imports will also be substantially reduced—by 44% compared to 2024, to 18.35 million tons [Bloomberg]. These measures aim to protect the domestic market from an oversupply of cheap steel, primarily from China. Concurrently, the EU hopes to negotiate with the US to reduce existing tariffs on European steel and to develop a common position regarding China.

-

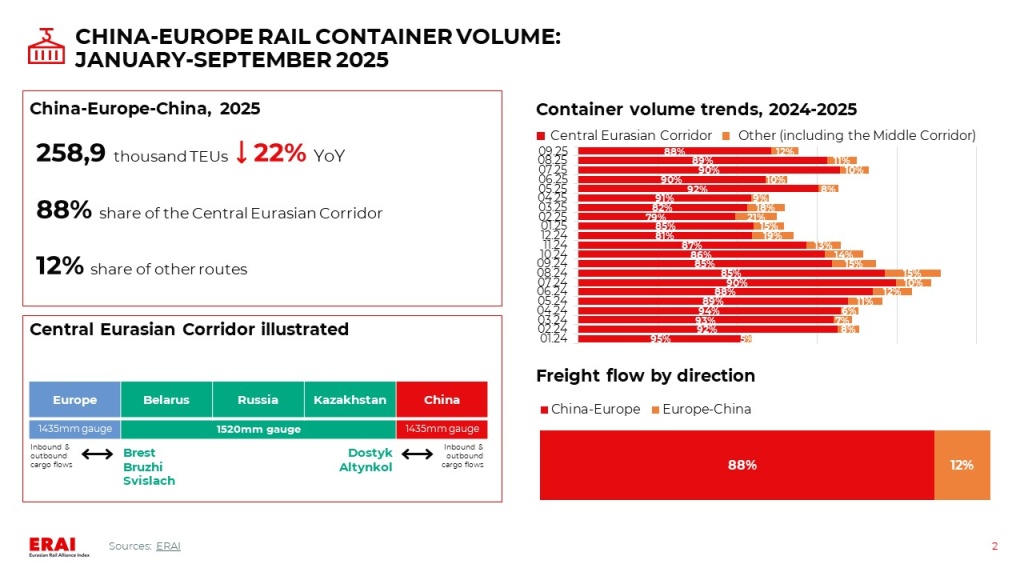

In January-September, the volume of China—Europe—China rail container transportation decreased by 22% YoY. In September, the total shipment volume across all competitive routes fell by 26% YoY and by 20% MoM. The volume decline in September compared to August was mainly due to a reduction in the Central Eurasian corridor. Within the TMTM corridor, a significant issue in September was the accumulation of several thousand empty containers in Azerbaijan, Georgia, and Kazakhstan—companies cannot find cargo for their return shipment to China [Argus].

-

Demand for Asia—Europe sea freight remains weak. According to Flexport, no signs of recovery are expected after the Golden Week.

Freight rate trends

-

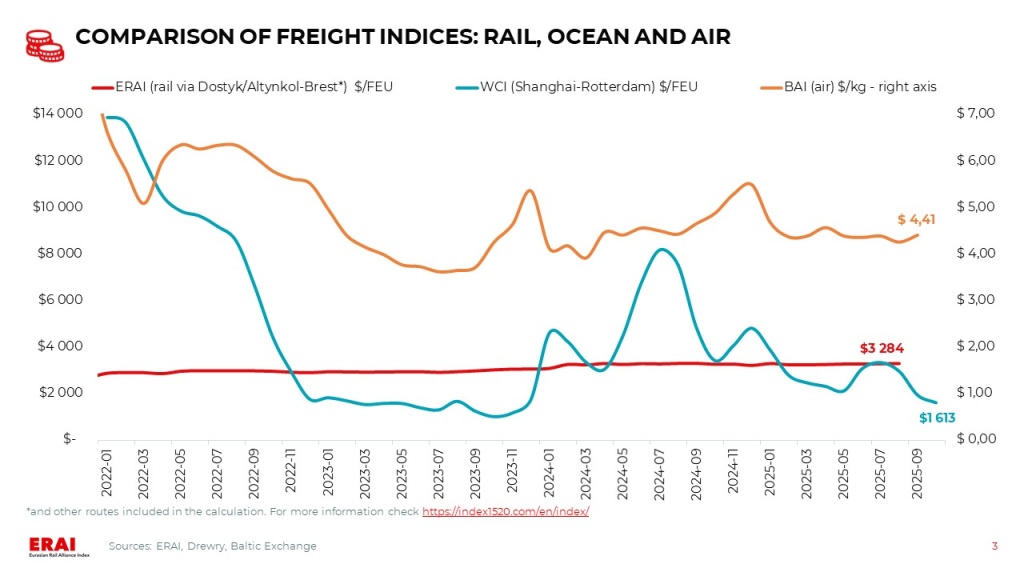

The Shanghai-Rotterdam WCI fell by 7% last week to $1 613/FEU (-32% MoM, −58% YoY) [Drewry]. Freight rates have returned to the lows last seen in late 2023. In mid-October, carriers announced a General Rate Increase (GRI), but the likelihood of its implementation remains low. According to GeekYum, for the second half of October, most carriers are quoting rates in the range of $1 800-2 100/FEU.

UPDATE: As of the evening of October 9, 2025, the latest WCI Shanghai-Rotterdam reading has declined by 2% WoW — down to $1 577/FEU.

-

Futures quotes signal an imminent market stabilization followed by a gradual increase until year-end. Specifically, Asia-Europe rates may decline to around $1 500/FEU by the end of October, with a subsequent rise to approximately $2 200/FEU by the end of the year.

Other trends

- Construction of the Serbian section of the Belgrade-Budapest high-speed railway has been completed. This is a flagship project of the Belt and Road Initiative in Europe [Xinhua]. The Hungarian section is expected to be completed in 2026.

China-EAEU logistics market

Import and export trends

-

The Russian Ministry of Finance has proposed increasing VAT from 20% to 22% effective January 1, 2026. The ministry explained this step is necessary to meet defense needs and social obligations to Russian citizens. The preferential 10% rate is proposed to be maintained for all socially important goods [Kommersant]. Bank of Russia Governor Elvira Nabiullina acknowledged possible short-term price reactions to the VAT increase to 22%, but stated this would not lead to sustained inflation acceleration [Kommersant].

-

Sales of new passenger cars in Russia reached 122.66 thousand units in September 2025, showing a slight increase from August (+0,3%), but declining by 18,7% YoY. Over nine months, the market volume reached 895.9 thousand cars, down 22,4% YoY. October sales are expected to rise to 130-140 thousand units due to buyer concerns about the upcoming recycling fee increase, with annual sales potentially reaching 1.2-1.3 million vehicles [AUTOSTAT].

-

In 3Q2025, road freight traffic across the Russian border (excluding EAEU) decreased by 7,8% YoY, totaling 428.1 thousand vehicles. Over nine months, transportation decreased by 7,5% YoY, reaching 1.2 million units. However, the China route showed growth: a 22% YoY increase over nine months, accounting for 40% of all road freight traffic. Export flow from Russia to China grew by 38% YoY [InfraNews].

-

The Russian Ministry of Transport has developed amendments to the Railway Transport Charter, introducing «take-or-pay» contracts for shippers [InfraNews]. According to the new rules, companies will be required to pay freight charges for the entire volume of transportation agreed with Russian Railways, even if the cargo is not actually presented. This will allow Russian Railways to guarantee loading of created infrastructure capacities and create conditions for railway network development. Public discussions of the draft will last until October 15.

-

As of early October, the situation at the Kazakh-Russian railway border was tense, with at least 30 trains detained for inspection. Transit trains to Europe were not affected, and shipments from the Chinese stations Dostyk and Altynkol continued normally [Vedexx]. Currently, trains are operating without delays.

-

Import rates in the China-Moscow multimodal corridor have remained virtually unchanged for a month, with the average transportation cost via Far Eastern ports at ~$4 000/FEU (SOC). However, rates for direct rail transportation have increased somewhat (+$400/FEU) and stand at ~$5 000/FEU (COC).

-

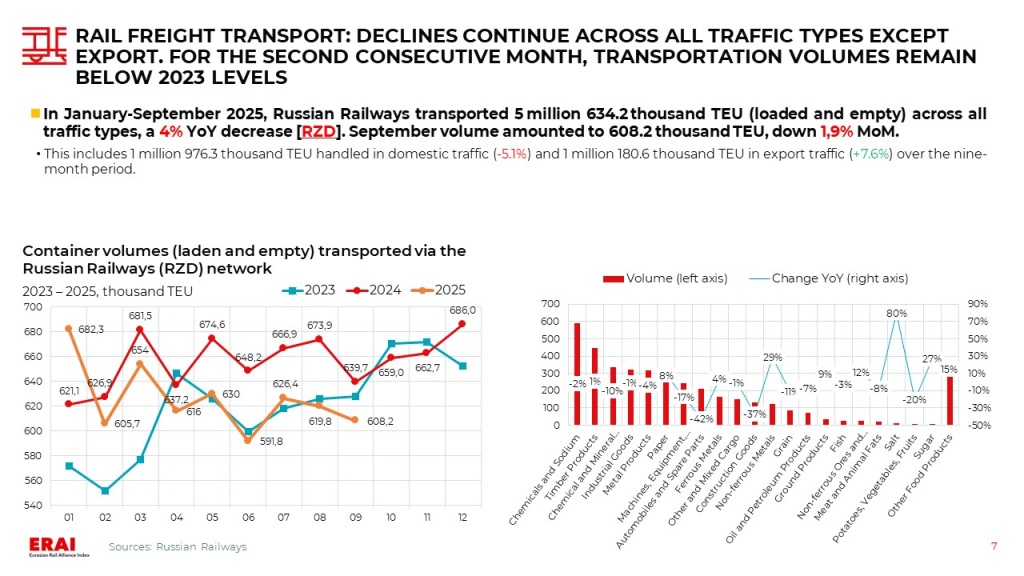

In January-September 2025, Russian Railways transported 5 million 634.2 thousand TEU (loaded and empty) across all traffic types, a 4% YoY decrease [RZD]. September volume amounted to 608.2 thousand TEU, down 1,9% MoM.