When using, citing, or distributing the materials from this report, it is mandatory to reference the ERAI portal and include the webpage address https://index1520.com as the source of information.

China-Europe logistics market

Demand outlook

- China’s economy grew by 5.0% YoY in 2025, reaching the government’s target benchmark [Reuters]. Growth was driven mainly by strong industrial output (5.9%) and exports (5.5%). Consumer demand showed more subdued dynamics (3.7%). An export-oriented growth model resulted in China posting a record trade surplus of $1.2 tn. A widening trade imbalance with the EU increases the likelihood of tighter protectionist measures by European regulators.

- In January 2026, industrial activity in the euro area returned to modest growth. The HCOB Eurozone Manufacturing PMI Output index rose to 50.2 after a contraction in December, but the headline manufacturing PMI remained in contraction territory (49.4) [S&P Global]. Export orders declined again, albeit less sharply than in December. This points to continued weakness in external demand, including from Asia, and provides no indication of a near-term pickup in shipments from Europe to China.

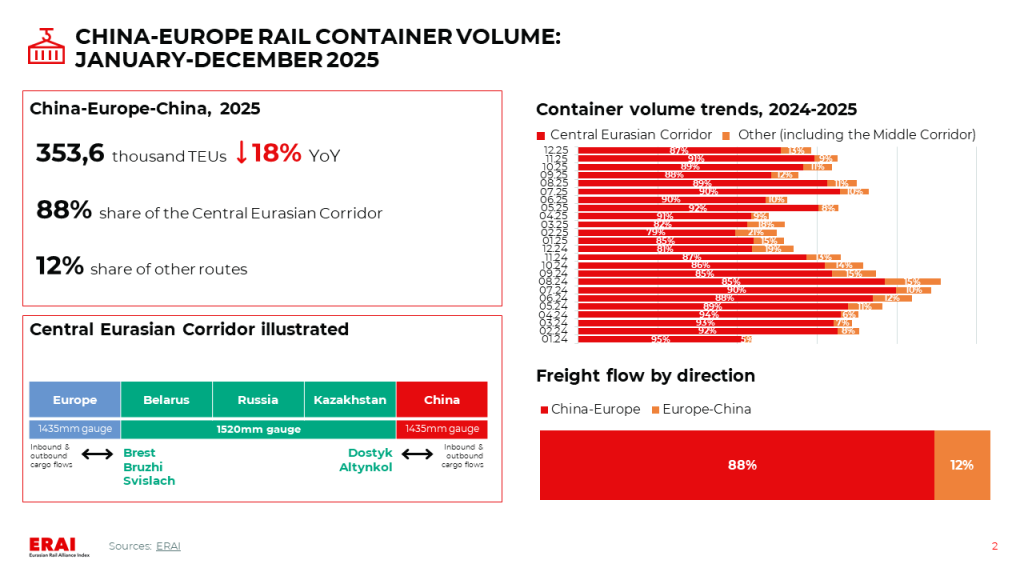

- In January-December, China-Europe-China rail container volumes decreased by 18% YoY, while the volume on the Middle Corridor increased by 14% over the year. In December, the total volume across all routes grew by 8% YoY but declined by 10% MoM. Seasonal delays in the Caspian Sea limit the Middle Corridor’s potential for cargo flow growth.

- Demand for Asia—Europe ocean shipping is starting to gradually soften. As Chinese New Year (17.02.2026–03.03.2026) approaches, the seasonal impulse is gradually fading. According to Flexport, most volumes have already been booked and the market is in a transition phase.

Freight rate trends

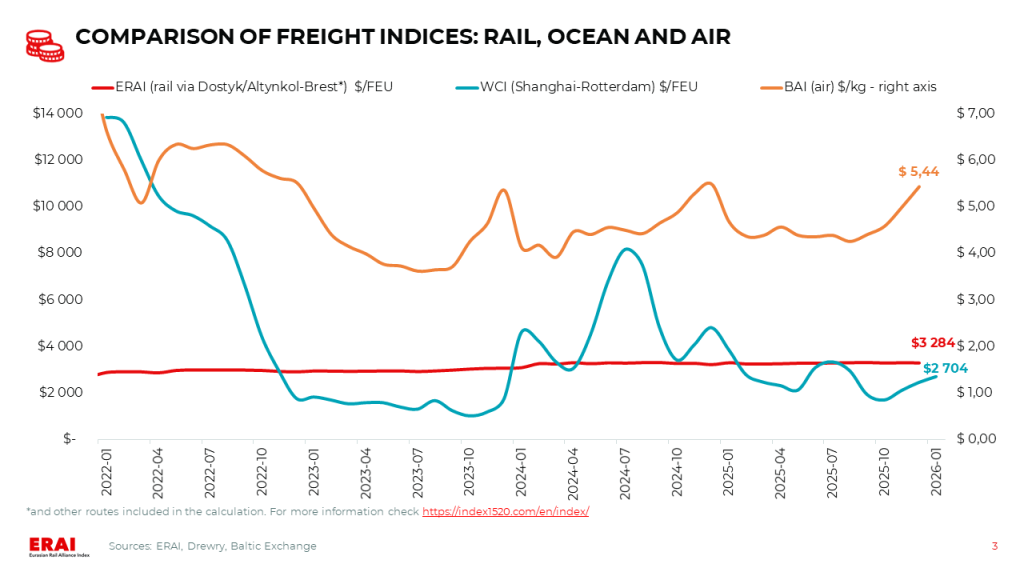

- WCI Shanghai—Rotterdam, as of 22 Jan 2025, declined to $2 510/FEU (-1% MoM, −27% YoY) [Drewry]. WCI Shanghai—Genoa fell to $3 520/FEU. Market conditions did not allow carriers to execute an aggressive pre-holiday rate-hike scenario. For the remainder of January and February, the lines are focused on keeping rates at current levels. According to GeekYum, the average February spot rate is $2 200–2 600/FEU.

- Futures market participants expect a decline after 1Q2026 and rates in the $1 500–2 000 range for most of 2026. Xeneta forecasts rates falling back to 4Q2023 levels (<$1 500/FEU) even in the event of a partial recovery of transit via the Red Sea.

Other trends

- DHL Global Forwarding launched the multimodal Truckair service on the China—Europe route [JOC]. The route combines trucking from China to Tashkent (Uzbekistan) and an air leg to Istanbul (Turkey), followed by delivery across Europe. Transit time to Turkey is 9–11 days. The service has been operating for about 2 months and is positioned as a solution for transporting large consignments, with a focus on predictable transit times and lower costs versus direct air freight.

- The Budapest—Belgrade railway line is preparing for launch [RailwayPRO]. Freight operations on the Hungarian section will open on 27 February 2026. The line will become a key link in the corridor for moving Chinese cargo from the Port of Piraeus, operated by COSCO, to Central Europe. Most of the rail line’s capacity has already been contracted.

Ocean freight: the market is entering a phase of seasonal cooling, with a risk of further deterioration in the supply—demand balance

Current Situation and Near-Term Outlook: gradual fading of the peak season.

- Demand for Asia—Europe ocean shipping is starting to gradually soften. As Chinese New Year (17.02.2026–03.03.2026) approaches, the seasonal impulse is gradually fading. According to Flexport, most volumes have already been booked and the market is in a transition phase.

- To serve the Asia—Europe trade, carriers deployed a record level of capacity in January (~1.15 million TEU), but a decline is expected in February (to ~1.0 million TEU). Announced blank sailings for weeks 8–9 indicate carriers’ intention to actively manage supply after the holidays. Disruptions in North European ports and equipment shortages in China are constraining effective supply, allowing rates to remain elevated.

- Significant delays persist in Asian and European ports. Key drivers include a surge in cargo flows, as well as adverse weather conditions and issues with handling and evacuating containers from European terminals (including via rail services). As of 25.01.2026, port delays amounted to 493 thousand TEU in Northern Europe (35% MoM) and 1.2 million TEU in North Asia (29% MoM) [Linerlytica].

- WCI Shanghai—Rotterdam, as of 22 Jan 2025, declined to $2 510/FEU (-1% MoM, −27% YoY) [Drewry]. WCI Shanghai—Genoa fell to $3 520/FEU. Market conditions did not allow carriers to execute an aggressive pre-holiday rate-hike scenario. For the remainder of January and February, the lines are focused on keeping rates at current levels. According to GeekYum, the average February spot rate is $2 200–2 600/FEU.

- CMA CGM again rerouted the FAL1, FAL3, and MEX services around the Cape of Good Hope, abandoning Suez Canal transit on the Europe-Asia leg [Xeneta]. The main reason is ongoing geopolitical uncertainty.