This is an important volume shift for China-Russia rail transport, considering that in 2022 the share of rail in the EV transport market was meagre. Several industry professionals had highlighted to RailFreight.com that the chances of increasing EV rail volumes were relatively low.

For instance, Olga Stepanova, CEO of Eurasia Logistics, had explained that traditionally, China-Russia rail volumes are dominated by products like building materials, industrial equipment, household appliances, and consumer goods and that the automotive industry did not prefer rail.

Moreover, Zhu Linlin, founder of LLC Translogistic, had highlighted that Russian EV imports were relatively low, at least until the end of 2022, since the Russian market preferred the cheaper conventional diesel cars option. On top of that, the rail logistics industry also had to deal with the fact that China imposed restrictions on transporting lithium batteries by rail, meaning there was not much potential for putting EVs on trains despite the increased demand.

On the other hand, Ganyi Zhang, political and economic strategist at Geodis, and sources from Chinese car manufacturer Great Wall Motor had explained to RailFreight.com that exports of EVs to Russia and Europe could occur by rail when shipping capacity would be tight, underlining that Ro-Ro shortages could result in a modal shift.

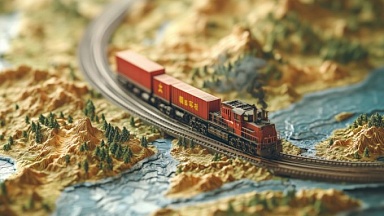

RZD deploys 40-foot containers

In the meantime, a lot has changed, and EV transport by rail between China and Russia appears to be on the rise. According to the specialised publication Automotive Logistics, RZD’s solution of transporting EVs in 40-foot containers has contributed the most to this shift. However, the Chinese government made the most significant contribution by lifting the ban on the transport of lithium batteries, thus allowing RZD to implement such a logistical solution.

So far, rail transport of EVs has developed through a dedicated route connecting only Chengdu and Moscow’s Selyatino. However, there are plans to expand the involved hubs by including Xi’an, Shanghai and other Chinese destinations.

On the other hand, Fesco, which is also involved in this business segment, has a more diversified approach since it dispatches finished EVs from China to Russia, either using Vladivostok as the entry point or Khorgos-Altynkol by land. Nevertheless, the company also recognises the benefits of transporting them in containers, considering the lower tariffs and the flexibility of not changing track gauge on the border crossings.