China-Europe logistics market

Demand outlook

-

The HCOB Flash Eurozone PMI by S&P Global indicates that manufacturing activity in the Eurozone remained in recession in January, though the decline slowed. Weak demand and reduced export orders continue to hinder economic recovery and demands prospects for container logistics.

-

The Chinese New Year and sluggish economic conditions in Europe are dampening demand. In the short term, maritime trade faces pressure from excess capacity and intense competition amid low seasonal demand. Long-term market trends will be influenced by: the resumption of transit via the Red Sea, additional capacity entering the market and exacerbating supply- demand imbalances, economic conditions in China and Europe, as well as U.S. tariff policies and subsequent shifts in global trade.

Freight rate trends

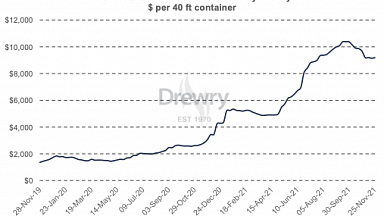

- WCI Shanghai-Rotterdam dropped 31% in the past month — to $3,274/FEU [Drewry]. Although reportedly there are rates on the market with severe discounts (Shanghai-UK: $2,300/FEU) [The Loadstar]. Rates may continue to decline both in the short and long term due to a multitude of market-related and other factors.

Other trends

-

In Kazakhstan, train traffic has been launched ahead of schedule on the second track of the Balkhash — Moyynty section as part of the construction of second tracks on the Dostyk — Moyynty line [Қазақстан теміржолшысы]. This project stands as one of the largest and most strategically important infrastructure developments for the central Eurasian railway corridor, linking China with Europe and the EAEU.

-

The Kazakh government has fast-tracked transport infrastructure development to enhance the Trans-Caspian route [Қазақстан теміржолшысы]. Key projects include: construction of the Moyynty — Kyzylzhar railway line, upgrades to the Kyzylzhar-Aktau railway corridor, expansion of the Altynkol — Zhetigen route.

-

ADY Express and Hellmann Worldwide Logistics have launched a joint cargo transport service via the Trans-Caspian International Transport Route (The Middle Corridor, TITR) [ADY Express]. A 55 FEU container train traveled through Kazakhstan, the Caspian Sea, Azerbaijan, and Georgia, reaching destinations in Eastern Europe, Turkey, and Germany.

-

«China-Europe Express» now connects Ningbo and Wilhelmshaven with a 26-day transit time, positioning itself as a viable alternative to rail transport [Global Times].

China-EAEU logistics market

Import and export trends

-

The Bank of Russia is observing a gradual slowdown in business activity growth and a decline in market optimism [Kommersant]. Russian companies are anticipating an inflation rate of 10.7% in 2025 [Kommersant]. On February 14, the Central Bank of Russia will deliberate on potential adjustments to the key interest rate. Most analysts expect it to be lowered or kept at the same level — 21%. The balance of payments assessment for December indicates further deterioration in foreign trade trends [Bank of Russia].

-

According to market participants, container rates remained stable despite the high season. With expectations of a slowdown in trade with China following the Chinese New Year. This seasonal trend may lead to a decline in rates thereafter [SeaNews].

-

Import rates from China have shown minimal fluctuation over the past two weeks, with direct China-Russia train rates at ~$8,900/FEU (COC). However, this is still a quite high level. Rates for shipments through Far Eastern ports of Russia are also at an elevated level at ~$6,000/FEU (SOC), of which ~$4,500 is attributed to the rail component.

-

Russian Railways is working on additional measures to increase transportation from the Far East. At the same time, operators continue to face challenges in securing empty wagons for incoming imports. Starting February 2nd, Russian Railways introduces a temporary ban on the transportation of empty wagons, regardless of ownership, from all stations of all railway administrations to all stations of Russian Railways to all consignees. The duration of the restriction is not specified.

-

Belarusian tax authorities have begun imposing VAT on the transportation of containers to loading/unloading sites for shipments under SMGS consignment notes [MTD RB]. However, non-residents are exempt from this requirement, providing a competitive advantage to foreign freight forwarders.

Other trends

-

In 2024, container turnover at Russia’s Far East ports reached 2.7 million TEUs, marking a 5% YoY increase [InfraNews]. Imports surged by 20% YoY to 1.24 million TEUs, while exports declined by 6% YoY to 690 thousand TEUs.

-

The road transportation sector has seen significant growth on eastbound routes. In 2024, 589,2 thousand trucks crossed the borders with Mongolia and China, reflecting a 48.8% YoY increase. Imports: 327.4 thousand trucks (+38.3% YoY). Exports: 261.8 thousand trucks (+64.4% YoY) [InfraNews].