Our detailed assessment for Thursday, 4 November 2021

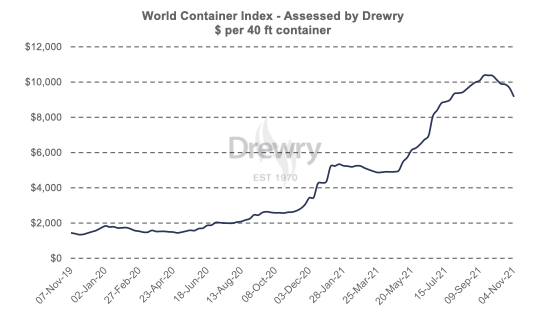

- The composite index decreased 4.9% this week, but remains 252% higher than a year ago.

- The average composite index of the WCI, assessed by Drewry for year-to-date, is $7,293 per 40ft container, which is $4,701 higher than the five-year average of $2,592 per 40ft container.

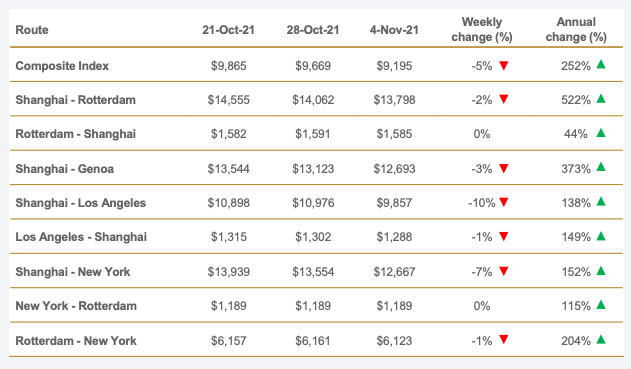

- Drewry’s World Container index composite index decreased 5% and reached $9,195.41 per 40ft container, but is 252% higher than the same week in 2020. Freight rates on Transpacific Eastbound lanes, Shanghai — Los Angeles dropped 10% or $1,119 to reach $9,857 and Shanghai — New York fell 7% or $887 to reach $12,667 per 40ft box. Similarly, spot rates from Shanghai — Genoa declined 3% to $12,693 and Shanghai — Rotterdam dropped 2% to $13,798 per feu respectively. Rates on Los Angeles — Shanghai and Rotterdam — New York fell 1% each to reach $1,288 and $6,123 per 40ft container. Rates on New York — Rotterdam and Rotterdam — Shanghai hovered around previous weeks level. Drewry expects rates to remain steady in the coming week.

Our assessment across eight major East-West trades: