Research basis

International Transport Corridors (ITCs) are multimodal routes for the transport of passengers and goods, including air, sea, rail and road links. Transport corridors are designed to create predictable and transparent routes for all players in the global logistics market.

Historically, the most important route was between East and West — China and Europe — but over time, other routes between north and south also began to develop.

Modern transport corridors do not have direct logistically connected routes and rather formally combine separate routes of several transport modes.

The study focused primarily on container traffic on the major East-West ITC that runs through Russia. The ITC includes 2 routes: China-Mongolia (optional) — Russia-Belarus-Poland-Germany and China-Kazakhstan-Russia-Finland. This transport corridor is formed informally by linking different sections of maritime, rail and road links from China to European countries.

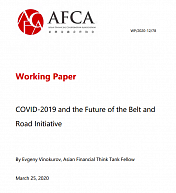

Trade level between West and East

Global trade volumes between China and the EU have shown steady growth over the past 5 years, rising by almost 23% from €441.5 billion in 2016 to €586 billion in 2020. High-value-added manufactured goods dominate the structure of trade, accounting for almost 97%.

Freight volumes between China and the EU also show growth, but less significant (+7%), from 108.6 million tonnes in 2016 to 116.9 million tonnes in 2020.

The performance of the EU and China in terms of container traffic reflects the worldwide trend towards increased containerisation of cargo. The authors of the study estimate that the containerisation rate of EU countries is significantly higher than that of China (5-10%) and reaches 20-41%. For example, EU container traffic for 2019 was 115.3 million TEUs, with an average annual growth rate of 4% from 2016 to 2019, and China was 242 million TEUs (+7% per year).

Russian specificity

In Russia, with a significantly lower volume of containerized cargo on the railway network (5.8 million TEU) than in China or the EU, the level of containerization of cargo reaches 9.8%. But despite its favourable geographical location between Europe and Asia, Russia’s potential for multimodal transport is hampered by the lack of transport infrastructure capacity and terminal and logistics facilities in the country.

As for the other countries in the Space 1520, although they are showing growth in rail container traffic between Europe and China, the volume is still much lower. At the end of 2020, they grew by 63% compared with 2019, and their volume reached 551 thousand TEUs.

Growth opportunities

Increasing containerisation, in turn, creates the need to develop the market for containers, both universal and specialised. On average over the past decade, global container production has amounted to around 3.6 million TEUs annually.

However, the current volumes of the global container industry do not cover the demand of shippers and logistics companies, which in the long term may hinder the active growth of international trade and cargo flows.

Russia also has several companies that produce both universal and specialised containers, but their production volumes are not comparable with the world’s and do not even meet the needs of the domestic market.

In addition to the development of transport and terminal infrastructure, the development of container production is also necessary to provide a full cycle of logistics services in Russia. And the use of special formats for implementing industrial infrastructure projects can make them more attractive to both government and private investors.